Get Your ITIN With A Quick, Secure, And Hassle-Free Solution

Certified Experts Providing IRS-Approved Services You Can Trust

Direct Communication with the IRS

Secure Online Services

U.S Bank Account Setup

Tax Filing Assistance

Start Your

ITIN Application

You Will Be Personally Working With...

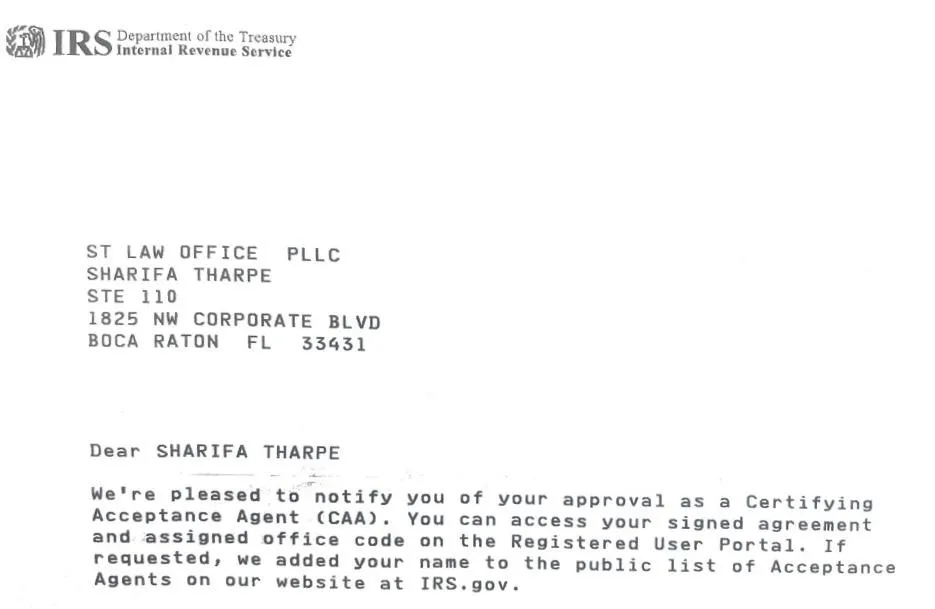

Atty. Sharifa Tharpe

Certifying Acceptance Agent (CAA)

As IRS Certifying Acceptance Agents, we're TRAINED and AUTHORIZED BY THE IRS to assist non-U.S. citizens like you who don't have a Social Security Number (SSN) get their ITIN.

Our team is fully equipped with the expertise and knowledge to guide you through the entire process, ensuring compliance with IRS regulations and protecting your information every step of the way.

You can find our Certification as IRS Certifying Acceptance Agents on the IRS website under "ST Law Office"

ST Law Office, PLLC

IRS Certifying Acceptance Agents (CAA)

Official Certification From the IRS Certifying ST Law Office, PLLC as

IRS Certifying Acceptance Agents

Top 3 Reasons to Use a

CAA to Get Your ITIN

NO Need to Send Original Documents

Without a CAA, proof of identity and foreign status must be sent to the IRS. This means that you would be mailing your passport to the Texas IRS office.

This will take weeks to process, and it will be risky and dangerous to put important documents like your passport in the mail.

As CAA's, we are certified and trained by the IRS to certify your identification documents ourselves, thus removing the need for you to send to the IRS.

We Communicate Directly With the IRS for You

We offer a dedicated support line to the IRS and a direct email contact with the ITIN office.

Exclusive resources not available to individual taxpayers. Without these connections, individuals must rely on mail correspondence, which can significantly delay the process if any issues arise.

We Do the Complicated Paperwork For You

Attorney Sharifa Tharpe, CAA, will handle every step of the process to ensure you successfully obtain your assigned ITIN.

JUST 3 EASY STEPS

TO GET YOUR ITIN

At St. Law Office PLLC, we specialize in assisting non-U.S. citizens without an SSN or ITIN in obtaining their ITIN quickly and efficiently, regardless of their location. Our streamlined process eliminates the need for complex legal forms, ensuring a hassle-free experience.

Submit our simple online form to provide your details.

Schedule a free consultation with our skilled team to review your situation.

Relax while we manage all the paperwork for your ITIN application.

JUST 3 EASY STEPS

TO GET YOUR ITIN

At St. Law Office PLLC, we specialize in helping non-U.S. citizens without an SSN or ITIN obtain their EIN easily, no matter where you are in the world, with no complex legal forms to deal with!

Submit our simple online form to provide your details.

Schedule a free consultation with our skilled team to review your situation.

Relax while we manage all the paperwork for your ITIN application.

Why Choose St. Law Office PLLC?

St. Law Office PLLC, led by Attorney Sharifa Tharpe, was founded with a mission to assist immigrants in obtaining their green cards and navigating the complexities of the immigration process. With over a decade of experience as an immigration attorney, Attorney Sharifa is deeply committed to supporting individuals as they strive to build their lives in the United States.

Recognizing a growing need for comprehensive tax services, Attorney Sharifa is excited to expand her offerings to include Individual Taxpayer Identification Number (ITIN) services. This expansion allows her to help even more people access essential resources and fulfill their tax obligations, while maintaining her commitment to outstanding, personalized legal support.

At St. Law Office PLLC, we understand the challenges immigrants face and are dedicated to finding tailored solutions that meet their unique needs. Your journey matters to us, and we are here to help you every step of the way.

Unlock the Full Potential of Your ITIN

Open a U.S. Bank Account

File Tax Return

Create an Investment Account

Apply for a Credit Card

Open a PayPal Account

Open a Stripe Account

Listen to What Our Past Clients Say

"Sharifa made my ITIN application process so easy! She was knowledgeable and responsive. Highly recommend her services!"

⭐️⭐️⭐️⭐️⭐️

"I had a fantastic experience with Sharifa. She guided me through every step and got my ITIN in record time. Thank you!"

⭐️⭐️⭐️⭐️⭐️

"Sharifa is a true professional! She helped me gather all the necessary documents and answered all my questions. Great service!"

⭐️⭐️⭐️⭐️⭐️

"I was nervous about applying for my ITIN, but Sharifa made it a breeze. She was patient and thorough. I couldn’t have done it without her!"

⭐️⭐️⭐️⭐️⭐️

"Excellent service! Sharifa was efficient and made sure everything was perfect before submission. I received my ITIN quickly!"

⭐️⭐️⭐️⭐️⭐️

"Sharifa is amazing! She took the time to explain everything and provided support throughout the process. Highly recommend her ITIN services!"

⭐️⭐️⭐️⭐️⭐️

Frequently Asked Questions

How long does it take to get my ITIN?

The processing time for an ITIN application typically ranges from 7 to 11 weeks. However, during peak times or if submitted from overseas, it may take longer, potentially up to 12 to 15 weeks due to backlogs

What can you do with an ITIN?

An ITIN allows individuals to file taxes, claim tax benefits, and open certain bank accounts. It does not grant work authorization or eligibility for Social Security benefits.

Can I use an ITIN to open a bank account?

Yes, many banks accept an ITIN as a valid form of identification for opening bank accounts, although policies may vary by institution.

Who needs an ITIN?

ITINs are required for non-resident aliens, their spouses, and dependents who cannot obtain a Social Security number but need to fulfill tax obligations.

What documents do I need to provide to get an ITIN?

To obtain an ITIN, you need to submit a completed Form W-7 along with proof of identity and foreign status, such as a passport or national identification card.

What's a Tax ID?

A Tax ID refers to various identification numbers used for tax purposes, including Social Security numbers, Employer Identification Numbers (EINs), and ITINs.

How will I be sure I will get my ITIN?

If you submit a complete and accurate application, you should receive your ITIN. You can check the status of your application by contacting the IRS after the processing time has elapsed.

Do I need to send my original passport?

No, you do not need to send your original passport. You can submit a certified copy of your passport or other acceptable identification.

Do I need to send my passport certified?

Yes, it is recommended to send a certified copy of your passport to ensure your identity is verified while keeping your original document safe.

Secure Your ITIN Without Delay! Stay Compliant and Avoid Hassles.

ST Law Office, PLLC

IRS Certifying Acceptance Agents

Mailing Address: 1825 NW Corporate Blvd. STE 110 | Boca Raton, FL 33431 (consultations and appointments at this location are by appointment only)

Copyright 2026. ST Law Office, PLLC. All rights reserved